Home > Finance Department > Funding

Funding

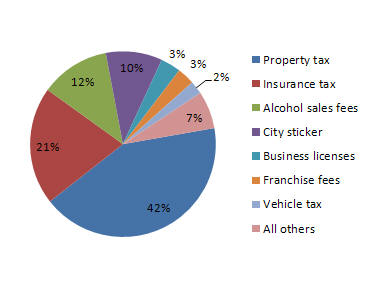

The General Fund receives its funding through taxes, fees, and licenses levied on City citizens, property, businesses, and activities. Listed below are the seven largest funding sources for the General Fund. These seven sources represent 93% of the General Fund receipts - net of transfers and incentives. It is from this funding that City leaders must draw the resources necessary to finance the City's governmental operations.

Looking further through the City's current fiscal year budget reveals that 85% of the General Fund's funding is derived from four sources: Property tax, insurance premium tax, alcohol sales tax, and the vehicle license tax (City sticker). Property taxes are levied on personal and tangible property as valued by the County PVA. Insurance premium taxes are assessed on insurance policies held by City residents. Alcohol sales taxes are assessed on all alcolhol sales within the City. City stickers are required on all vehicles of those persons who live or work in the City.

|

|

||||||||||||||||||||||||||||||||||||||||||

Updated funding source reviews - year over year comparisons of the City's seven largest funding sources - are available in the downloads section below.

Also available are detailed year-to-date summaries for property tax receipts, alcohol beverage control, city sticker, and current business licensees.

Downloads

- FY2015 General Fund Funding Source Review

- CY2014 Property Tax summary

- FY2015 Alcohol Beverage Control summary

- CY2015-2016 City Sticker Sales summary

- Current & Active Business Licenses

Questions, comments, concerns? Contact finance@murrayky.gov